While forecasting has always being associated with uncertainty, we are living during an unprecedented time that requires extra special handling. This article attempts to analyze the impact of Covid-19 beyond the near term, focusing on the entire year horizon.

As we are in the middle of the pandemic, it is difficult to know exactly how to react and what to prepare for, but there are certain things we can anticipate in terms of how consumer behavior will change over different time horizons, and how that will affect our forecasts and plans. Here I present a framework to understand how Covid-19 and lockdown impacts consumer behavior, and subsequently, the demand impact on your product portfolio.

Segment Products According To Necessity

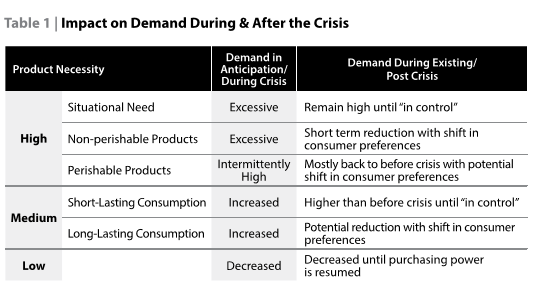

During a crisis, product demand can shift from certain products to others as some items become more important to your customers or consumers than others. It is important to organize your products based on necessity and know how their demand is changing in this new environment. While there are a lot of interesting insights about consumer behavior during this current period of quarantine which is affecting demand, for the purposes of this article we will look at the longer-term impact of the current situation on demand. The below table below is organized to show anticipated impact on demand according to product need, both during and after the crisis.

Planning For High Necessity/Essential Products

High necessity goods can be categorized into three buckets based according to the demand during this pandemic.

Situational High Need Products: Considered as essential by consumers in order to “fight” the crisis which, in the present situation, are associated with flu-prevention and alleviation, including but not limited to masks, sanitizers, and medications. Excessive demand for such products has led to scarcity and re-shifting of supply to respond to this newly-formed need. Demand for such products will continue to be high until consumers feel “in control” of the situation and their demand is fulfilled because products are available for purchase and/or they no longer have to respond to the situation that caused the pandemic because a vaccine is available. If you have high situational need products in your portfolio, plan on constant demand sensing and longer-term gradual demand reduction.

Non-perishable High Need Products: These are considered as essential by consumers in normal circumstances and have a shelf-life long enough to last the isolation period. Examples include packaged and long-lasting canned goods, consumable paper products, and cleaning supplies. Excessive demand for such products has led to scarcity due to consumers stocking up, causing the so called “pantry loading” effect. Given how long these non-perishable products last, it is possible we’ll see a reduction in demand post-crisis, caused by consumers who stockpiled such goods at the onset of the pandemic. If you have non-perishable high need products in your portfolio, plan on the “pantry loading” effect wearing off consumer preferences shifting to other products.

Perishable High Need Products: These are considered as essential by consumers in normal circumstances, but unlike non-perishable/long lasting products, have an expiration date and/or special storage constraints. Examples are fresh food like fruit, vegetables and meat, which saw intermittently high demand as consumers were stocking up in anticipation of lockdown. Consumer can increase the “lifespan” of such goods through freezing but to a limited extent as there refrigerating storage constraints. If you have perishable high need products in your portfolio, demand to return to normal levels, but plan on a potential shift in consumer preferences.

Planning For Medium & Low Necessity Products

Medium necessity products are those not essential to sustaining life but considered by consumers to be essential to satisfying psychological needs. Some of these products saw the biggest level of demand transference due to store closures and companies limiting their operations. Medium necessity goods are categorized into two buckets:

Short-Lasting Consumption Medium Need Products: Examples include books, movies, games, office supplies, wellness and beauty products, and seasonal merchandise. As consumers were, and will continue to be, more isolated in their home, demand for such products will remain elevated until they feel safe to return to their usual activities.

Long-Lasting Consumption Medium Need Products: These products have an extended consumption lifecycle like sports gear, office equipment, and basic home entertainment and improvement supplies. As consumers were forced into a “do it yourself situation”, i.e. cutting their own hair, working out at home, carrying out car maintenance etc., they frontloaded this demand that which might lead to potential reduction until the effect wears off.

If you have any medium need products in your portfolio, plan on constant demand sensing and be prepared to respond to any demand shifts.

Low necessity products: These are considered as “extras” by consumers like high fashion, expensive merchandise not serving stay at home or outside safety functions. Demand for such products has decreased due to anticipated economic instability and decreased spending power in light of increased unemployment and will continue to be low until consumers gain confidence and purchasing power returns.

Post Crisis & Demand Shift & Planning Ahead

While demand at the time of disruption depends heavily on product necessity, some things remain the same. The shift from buying in physical stores to online is applicable to all products irrespective of their necessity. Triggered by government mandated store closures, stockouts in physical stores, and individual safety concerns, consumers adjusted their purchasing channels, which has compounded an existing trend, with many more people buying online. This will continue post-crisis as a significant portion of these consumers will stick to this channel, preferring the convenience of the online shopping over physical stores. We must anticipate a medium- and long-term demand shift towards the online channel.

As a result of stockouts, consumers were forced to buy branded and non-branded items that they wouldn’t have bought under normal circumstances. A portion of these consumers will not return to their pre-crisis brand preferences.

Similar to the way we would handle a dramatic events such as a hurricane (but on a much larger scale) demand planners need to ensure that excessive or depressed demand caused by Covid-19 is associated with distinct causal factors and/or be tagged as outliers, depending on the forecasting solution used by the organization.

- If your organization uses sophisticated causal based algorithms for demand forecasting, it is recommended to break down the Covid-19 period according to geographical location and supply the forecast engine with regional Covid-19 data (these are our dramatic impact attributes), allowing us to develop measures for each region according to outbreak severity.

- If your organization is relying on time series techniques, you will need to mark data points during Covid-19 as outliers. But this needs to be done post-crisis, allowing demand forecasts to react to recent trends for the duration of the pandemic.

While there wasn’t much we could do at the outset of the Covid-19 outbreak, there is a lot we can do as we exit the crisis and in the period following it. These periods require careful planning and consideration. As demand planners, it is in our DNA to deal with uncertainty and even if the current situation is a lot more extreme than we are used to, our usual approach of combining the “art and science” will allow for robust short, mid and longer term forecasts. Plan on continuous demand sensing based on product necessity and anticipate demand shifts for the year ahead and be aware that as demand returns to “normal”, there will be new consumer trends to plan for.

This article originally appeared in the Spring 2020 issue of the Journal of Business Forecasting. Click here to become an IBF member and get the journal delivered to your door quarterly, as well discounted access to IBF training events and conferences, members only workshops and tutorials, access to the entire IBF knowledge library, and more.