As we close out 2021 and look forward to 2022, it is natural to speculate about what might happen in the global supply chain over the next three to six months. This time horizon is material to me in part (and cynically) because I don’t believe that any prognostication more than six months forward is worth considering. However, I do believe that whatever happens during the next few months will set the tone for the balance of 2022 – and there is value in considering what we are likely to see next.

If we pull back a bit, supply chain conversations over the past few months have mostly focused on supply chain “Grinch” stories. How supply chain woes were going to ruin Christmas because of a lack of inventory. But now that Johnny and Mary have their Christmas electronics, we should begin to emerge from the crunch and push for finished goods inventory to handle the post-holiday consumer onslaught and commence the dialogue about when we might expect a loosening of logistical resources to help with the long-awaited reset.

I envision (and hope for) a short window of time to allow the global supply chain to work through its much needed catch-up. And with luck, this catch-up should trigger a cascade of changes in the North American supply chain. I am hoping that when we look back at the first half of ’22, some of the following will have already occurred:

Our Ship(s) Will Finally Come In

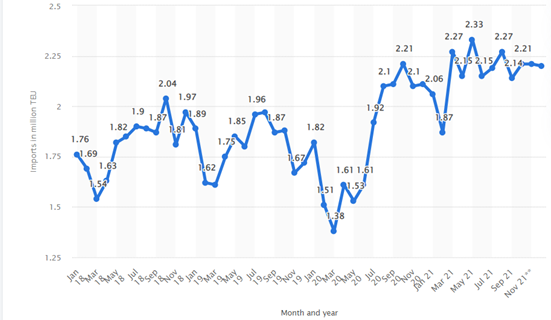

Port backlogs will ease, and product will flow. This does not mean the volume flowing through our ports will decrease, but that the normal, seasonal lull that occurs in late winter/early spring will be used to ease current backlogs and release months of inventory currently on the water. Note the historical import seasonality illustrated in Figure 1 represented as shipping container TEUs (twenty-foot equivalent units.)

This should eventually trigger a cascade of containers being redistributed eastward and a corresponding reduction in container pricing and ocean freight costs. It will also release months of inventory that is currently awaiting off-loading, allowing inventory to repopulate throughout the supply chain.

If this projection is correct, it will set the stage for a much more balanced outlook for the second half of 2022. Already the oft-discussed port of LA has experienced a decline in year-over-year activity over the last six months, which leaves me optimistic that we are past the peak. Hope springs eternal.

Figure 1—Millions of TEUs Imported (Source: Statistica)

Inventory Will Gradually Come Into Balance

As finished good inventory clears the ports, out-of-stock incidents at retail will subside and trade inventory levels will rise. It remains to be seen if inventory levels will rise to historical levels, but we should see some immediate relief by the second quarter. And of course, higher inventory availability will calm the retail supply chain.

One significant but little-discussed truth about inventory, however, is that component and raw material inventories are mismatched at the manufacturer level. I often use the example of body wash to describe this problem. A manufacturer of body wash may have plenty of labels, and bottles, but not enough caps—or fragrance—to complete the finished good. An informal survey I conducted among LinkedIn associates a few months back suggested that about 40% of inventory in manufacturing is mismatched and will remain so until all required component inventory arrives, allowing for the completion of end item production and for internal imbalances to heal. I suspect that actively managing these mismatches downward will be an important effort in the first half of 2022 for most manufacturing organizations. Easing these mismatches will “complete” finished good production and enable inventory to move down the supply chain into retail thereby reducing out of stocks.

Demand Variability Will Calm

In terms of demand variability, nothing is more disruptive than out-of-stocks; they trigger hoarding behavior among both consumers and retailers, sending automated replenishment algorithms throughout the supply chain into tizzies, while wreaking havoc on forecast pacing with manufacturers.

These days, however, I find myself talking more about total network variability, since an out-of-stock creates excess demand requirements for not only retailers, but also at manufacturers’ distribution and production centers, and in supply chain tiers far below the finished goods manufacturers.

As we continue transitioning back to normal, the level of automated inventory growth, excessive manual intervention, and plain ol’ bullwhip effects should subside as inventory becomes more available throughout the supply chain. I also suspect that as the waves of covid subside, everyone will become more confident in resuming lifestyles marked by a mix of more services and less consumerism cooling off the red-hot demand for consumer goods. This will likely lead to rebalanced demand and…

There Will Be A Wave Of Order Cancellations

I know of one retailer that placed orders for millions of dollars’ worth of hand sanitizers at the peak of market demand, only to cancel all the orders a month later when the market became saturated—no pun intended. This action burdened the manufacturer with extra alcohol, fragrance, packaging, and glycerin — to both store and rationalize. It was ugly, but the manufacturer took it on the chin because of a desire to maintain a long-term relationship with its retail client.

This was an expensive object lesson, and one best learned on someone else’s dime. As COVID loosens its grip and the demand for consumable end items relents and stabilizes, I predict a wave of considerable order cancellations as each supply chain tier puts the brakes on excessive inventory. It will start at the retail level, since retailers are very sensitive to inventory carrying costs, and then it will cascade back through the supply chain. So, if you are a second- or third-tier supplier of some retail consumable, it might be dangerous to consider your seven to nine months’ worth of order bookings as “firm”. I suspect at least some of that demand will prove to be artificial i.e., just-in-case or “placeholder” orders that are easily cancellable, leaving you with little recourse.

Transportation Price Declines Will Cause Havoc

With rebalanced demand, available containers, and normalized material flows, it is easy to project a decline in transportation pricing across the board, and I note that some of these costs have already plateaued. Ocean booking, container and LTL shipments should all see deflation compared with 2021 costs. This will lead reasonably retailers to expect that manufacturer prices will decline proportionately, since many manufacturers took pricing actions based on covid-related disruptions and increased logistics costs.

But will manufacturer pricing ultimately decline? I don’t know. But I suspect there will be a lot of conversations about pricing between buyers and salespeople over the next year. Part of me believes the current higher pricing will be sticky and hold, yet I know it will only take one provider, one manufacturer, or one service provider moving to a lower price to trigger the market toward more pricing efficiency.

So, What’s Next?

Of course, no one can estimate exactly what will happen. And I was one of those people who thought this whole supply chain mess would come to an end in early 2021, so I have been no more accurate than others. Ultimately, the potential of any possible outcomes lies with improved port backlogs, so if you are looking for one metric to keep a close eye on, I would suggest focusing on backlogs first.

Are there other issues contributing to this mess? For sure. Warehouses have limited receiving hours, carriers are restricted by hours-of-service rules, there are not enough chassis for drayage, transloading has been inefficient, and port clearance has gotten worse not better. But with the prospect of improved port throughput and a traditional post-holiday lull, we may finally see some light at the end of this tunnel. I wish all readers a wonderful and hopefully renormalized 2022.