In the world of Operations, we want our businesses to run like an assembly line, where people and tools are in sync. The reality, however, is very different.

This is because each team in a company acts as a separate “tribe”—a community with its own culture, its own ways of thinking, and its own agenda. The differences come to light in the planning process when Sales, Finance, Marketing, and Supply Chain teams gather to forecast demand and supply. Too often, I have witnessed consensus forecasting meetings turn into chaos, when each tribe strives to achieve its own agenda. This is because the company is not aligned to a single direction. The most successful S&OP process is driven by the CEO or GM of a company. This is because the top executives bring in a single direction, as opposed to multiple directions, practiced by different tribes (silos).

What is S&OP?

S&OP is a business process that occurs in all high-performance manufacturing firms. It ensures that demand is properly planned for and then shared across the organization. The demand of about 18-36 months into the future (depending on the industry) gives ample information to manufacturing and supply teams to plan for capacity, and close the gap, if any. S&OP is an integrated business process that drives collaboration, and brings alignment across multiple divisions and departments. The implementation of S&OP often results from companies recognizing that long-term market success requires more than just branding products.

Challenges of an S&OP planning process

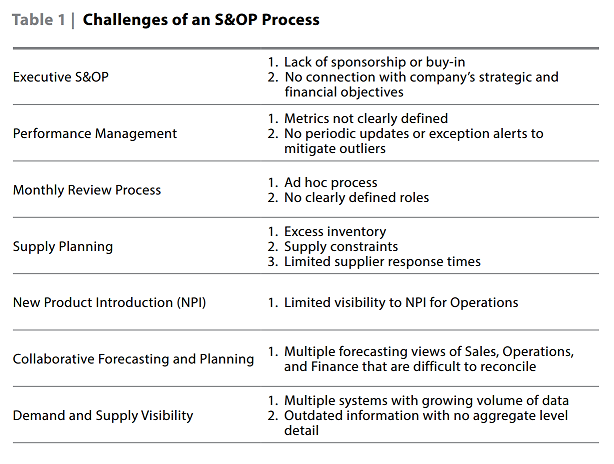

Most of the challenges of an S&OP planning process are related to Executive S&OP, Performance Management, Monthly Review Process, Supply Planning, New Product Introduction, Collaborative Forecasting and Planning, and Demand and Supply Visibility. (See Table 1)

Executive S&OP: The executive component of the Sales & Operations Planning process is known as Executive S&OP, which is one of the most important business practices. Properly implemented, it can transform the way a company operates, thereby increasing revenue and margin.

To ensure an effective and efficient S&OP process, the first and foremost requirement is top management buy-in, as well as top management’s involvement in the decision-making process. Equally important is that the strategic vision of a company is well aligned with its financial objectives. A good S&OP process can easily achieve it. Companies must understand that aligning planning and execution across the company has now moved from a competitive advantage to a competitive necessity. The success in the Executive S&OP comes not only from the proper application of its tools, techniques, and processes, but also in large measure from people working together and their willingness to bring tough issues into the open.

The Executive S&OP report (Executive or Company Operating Plan) and KPIs used in Executive S&OP meetings should be of a higher level than those used in Pre-S&OP. For example, in Pre-S&OP meetings, products are usually viewed at family levels. In the Executive S&OP meeting, they are viewed one level up—at a business unit, geography, or company level. Their expected outcome is matched with the P&L they are aiming at. If there is a gap, a plan is made to close it.

Performance Management: To ensure the success of a process and system, it is imperative to have well-defined KPIs. Once KPIs are defined, the next step is to monitor and track performance. Annual plan targets are evaluated against key metrics—both operational (such as on-time delivery, inventory projections, and capacity utilization) and financial (such as revenue and margin)—to ensure operational plans are consistent with financial goals. A few of the KPIs that can be measured are:

- On Time In Full (OTIF)

- Out-of-Stock (OOS)—Actual and Predicted

- Shipments Right First Time (SRFT)— Inbound and Outbound

- Conformance to Plan (CTP)— Inbound and Outbound

- Inventory—Days of Inventory Outstanding and Days Forward Cover

- Forecast Accuracy—Accuracy and Bias

- Cost to Serve 8. Write Off Value—Waste Management

- Warehouse Capacity and Utilization

- Invoice vs. Budgeted Target Obsolescence

Monthly Review Process: An S&OP process will be successful only if it gets the right focus. All levels of the organization adhere to the monthly process, and final numbers are signed off in a timely manner. In many cases, we see that, after a while, the top management starts losing interest in the process. Their involvement helps to ensure that all stakeholders actively participate and strictly adhere to timelines. It will also help if all the stakeholders are well aware of the benefits they and the company will derive from this process.

[bar group=”content”]

Supply Planning: The supply planning process ensures that products are available when they are needed, and they are produced at the lowest cost and with the highest quality. Supply review meetings are held at the manufacturing site. The main focus of these meetings is on the answers to the following questions. How should we respond to demand? How much inventory should we hold? What should be the priority for production? Is there a need to expand capacity? Do we need an extra shift? How should we allocate products if there is a shortage? In crafting the answers to these questions, the supply planning takes into account its future plans based on the market forecasts of next 24-36 months. Capacity planning is carried out on the basis of future demand requirements, as well as the company’s strategic goals. Supply planning teams across the globe are constantly trying to reduce the lead time to provide best service levels. Supply management also tries to ensure that the inventory is managed optimally, and obsolescence is minimized. If there is any possibility of a shortage, the supply planning teams must let the S&OP team know ahead of time.

New Product Introduction: Competitive pressures, cost challenges, and increased customer expectations are driving companies to improve the way they develop and introduce new products. Whether the idea comes from within, or whether the new product is trying to respond to customer needs and market demands, the new product introduction process is a must. It enables all constituents to speak the same language. It automates tasks, exposes bottlenecks, and drives consistent execution and continuous improvement. Above all, it provides to management visibility into the product development pipeline. Since new product introduction is intertwined with other product development processes, its adoption and execution significantly influences your potential for success. One of the greatest challenges companies face is limited visibility to the pipeline. Since research and product development teams work in closed silos, they tend to forget that there are cross-functional dependencies because the production capacity is shared. Therefore, it is important to hold joint planning sessions within a company, at least a year before the launch, so that all stakeholders know the future aspirations and plans of other marketing teams.

Collaborative Forecasting and Planning: While surveys consistently show that Supply Chain managers consistently rank forecast accuracy at the top of their list—in reality it is nothing more than wishful thinking. True forecast accuracy requires close collaboration, which is missing, because most of the functions work in silos. Therefore, one of the biggest challenges for the various functions— such as Marketing, Sales, Finance, and Supply Chain—is to work together and build a consensus to arrive at one-number, unbiased forecasts. More often than not, we encounter situations where numbers from the various teams need reconciling through a gap analysis process. For instance, according to the historical trends of a product, the forecasting systems reach a volume figure. But, due to the fact that Marketing teams are running special campaigns and promotions, the Sales forecast from their end seems higher for particular time frames. This is where the two-way dialogue takes full effect, and ensures that teams within the organizations start working out of their silos.

Demand and Supply Visibility: Once all the above requirements are met, it is very important to ensure that the market’s demand is translated correctly into supply and manufacturing numbers. These numbers should be monitored monthly. Lack of visibility into inventory and how forecasts are translated into supply numbers cause imbalances between supply and demand, thereby causing excess inventory, and risk of regulatory non-compliance. The visibility about inventory and collaboration across Supply Chain partners will improve efficiency and financial health as well.

Lessons learned

Following are lessons that I have learned for making S&OP robust:

- Implement technology that fits into the process: S&OP is an integrated process, encompassing both process and technology. If you focus just on implementing a new technology, thinking the process will take care of itself, you are wrong. You must first set up the process, and then look for a technology that fits into the process.

- Anticipate outside initiatives: Typically, events that impact most adversely your business are the ones that come from outside and, thus, are not within your control. These are actions taken by your customers, partners, and competitors. The best you can do is to anticipate them as best you can, and then take the appropriate action.

- Focus more on information, less on data: Often we spend huge amount of time in collecting data, and very little in analyzing and finding the relevant information. What matters are the data that are pertinent to the problem, not the amount of data. The best strategy, therefore, is to decide first on a problem you wish to solve, and then look for data that are relevant to it.

- Effective leadership is must: S&OP crosses organizational boundaries, which is a source of strength, as well as vulnerability. Many businesses find that their attempt to implement S&OP is frustrated by tension between departments. This can be resolved if the CEO actively participates and owns the process. If it is not possible, then the next best solution is to motivate different department heads to set collectively ground rules and boundaries for working together.

Benefits of S&OP excellence

S&OP is a vital tool to increase communication, improve service levels, decrease costs, and have better capacity utilization in all parts of the Supply Chain. However, there are companies that have been using the process for years, yet have not fully reaped its benefits. Furthermore, given the ever-increasing challenges and complexity within the value chain, S&OP is becoming more and more difficult, requiring a new look at the level of granularity and analytics to improve forecasts. There are several steps that businesses can take. The most important one is to work collaboratively with the network of retailers and suppliers. With that, manufacturers don’t need to guess about what is selling and what is not, what their outstanding inventory is, and promotional plans are; they have access to all that. All these enhancements in Key Performance Indicators of the End-to-End Supply Chain have a direct and positive implication on the Profit and Loss Statements of the company.

The cross-functional S&OP team of senior managers is essentially responsible for re-charting the course of a business to achieve annual corporate financial targets. Whenever it detects that the business is not on track, it alerts the executive team and re-works the plan and, if necessary, revises targets.

At GlaxoSmithKline, we have done all of the above. The collaboration has brought more trust and engagement of the Sales team in the demand forecasting process. Less time is now spent on debating and arguing, and there is a real feeling of shared ownership of forecasts. Our forecasts have significantly improved. Our Sales team feels confident in committing to our customers.

GSK Demand Managers will deliver speeches at the upcoming Supply Chain Forecasting and Planning Conference next month in Dubai so you’ll be able to learn more on how to improve your S&OP. Click here for more details.